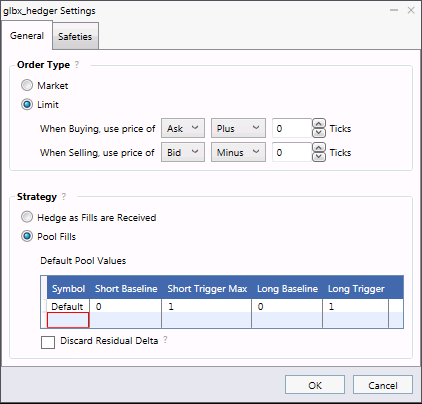

The BTS Auto Hedger automatically hedges electronic trades executed through the BTS Edge system. Our Auto Hedger’s operation is customizable in several ways including the order type to use, the hedging strategy employed and what safeties checks should be enforced. We'll briefly touch on the hedging strategies here.

The simpler of two hedging strategy options is to immediately fire a hedging order for any option fill with sufficient delta. Using this strategy, any fill with less than the required delta will be ignored.

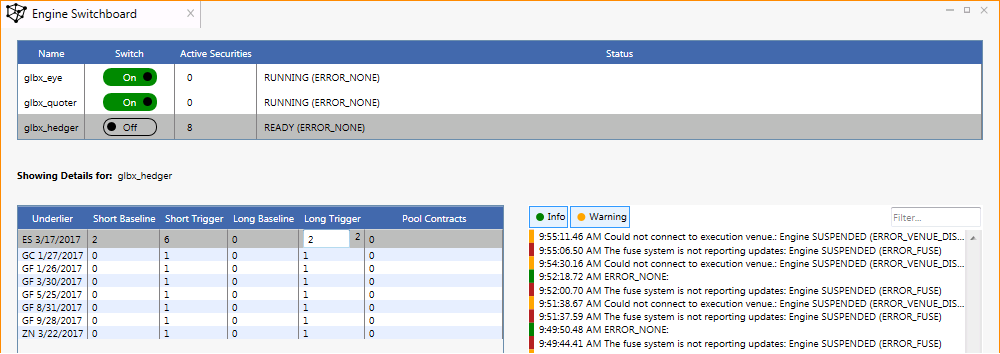

The Second option is our new delta pool Auto Hedger. With the delta pool hedger, the delta from every trade of a hedging security adds to the tally of the delta to be hedged. This continues until the pool reaches the specified size. Once the delta pool is full, the hedger fires either a limit or market order to bring the pool back to the configured baseline.

To learn more about our delta pool hedger and how it can work for you, click here to email or call us and we will be happy to answer your questions or give you a demo.