Blue Trading Systems’ Taha Afzal and Kevin Darby attended the FIA Boca conference last month in Boca Raton, Florida. Many of the sessions focused on how regulation impacts our industry and therefore, our technology. Blue Trading Systems is committed to helping our customers stay compliant through technology. We include 15c3 risk checks within the software and are also developing a leverage report to help firms stay under Basel capital limits.

Regarding regulatory risk management, Blue Trading Systems' clients leverage safety and security features within the BTS software. With the regulatory topic fresh in our minds from FIA Boca, we wanted to outline some features within our platform that help our clients daily. With trader and account permissions, a built in SPAN margining system, and other risk limit functionalities, traders are able to maintain margin requirements as well as prevent erroneous trades, which allows risk managers to do their jobs more efficiently.

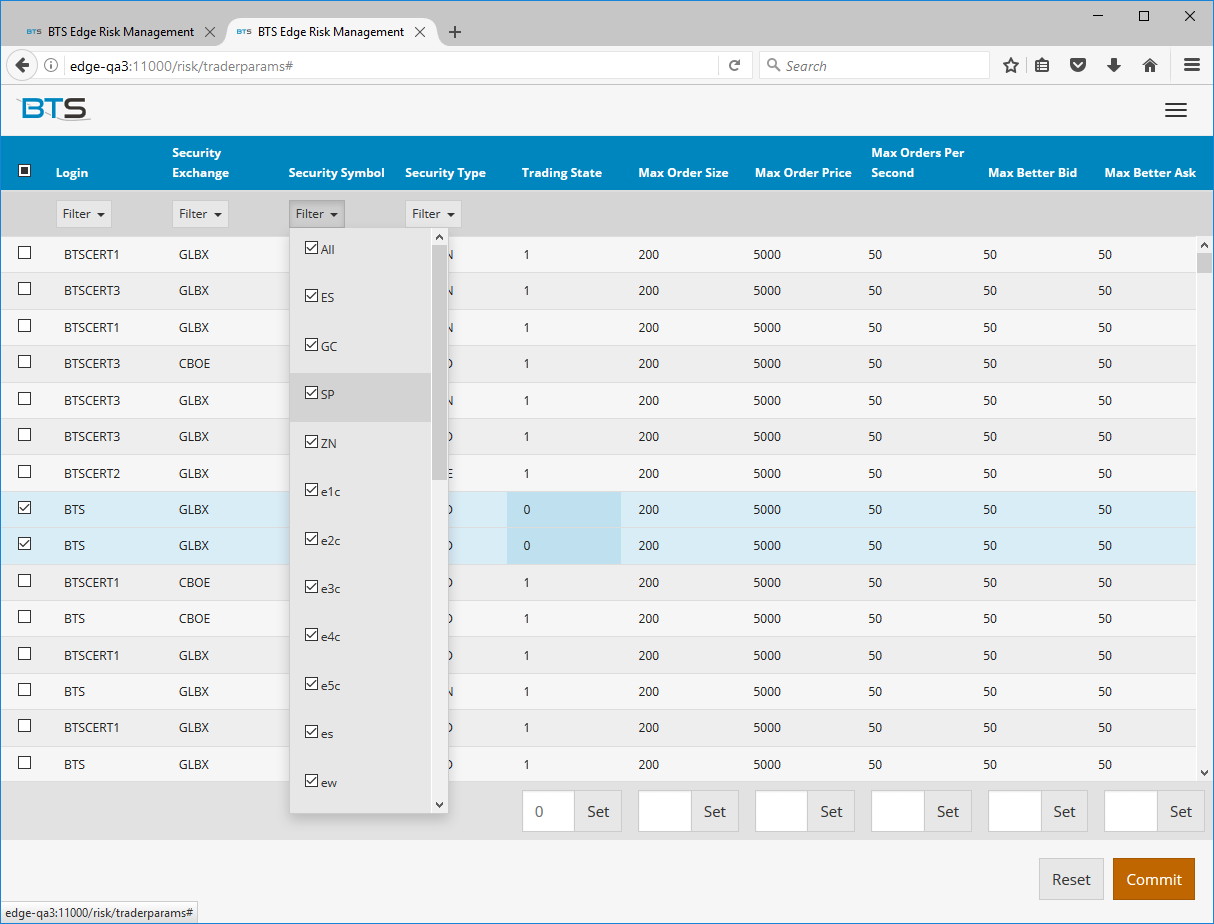

Trader and Account Permissions

Risk managers can set permissions by login or by account within the BTS solution. Limits can be categorized by User, Exchange and Security and include maximum order size, price, order rate as well as the maximum amount an order can improve the market.

Risk managers may also set the maximum long and short futures and options allowed in an account as well as the maximum allowed total long or short options premium in dollars.

SPAN Permissions

Our live SPAN Margining System helps traders and risk managers manage margin requirements throughout the day. BTS continuously calculates a standard SPAN array and reports net performance bond requirements to the user. Risk managers set live margin limits per account and the BTS system rejects orders that violate margin requirements. Risk managers can also manage margin through a Leverage Factor or Balance Adjustment feature, both of which are used to adjust an account’s available margin.

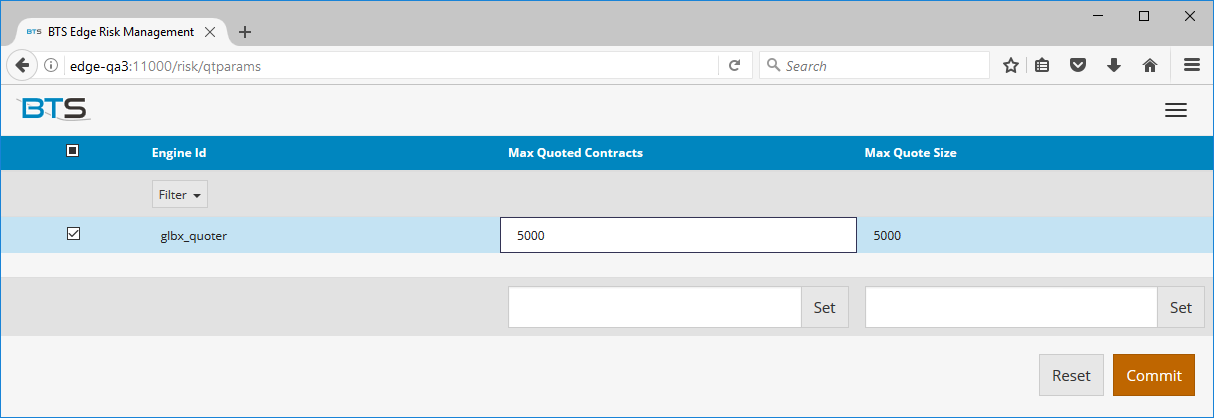

Quoter and Hedger Limits

The BTS system also includes limit functionality on electronic-eye, quoting, and hedging. The monitoring system will evaluate the bid/ask spread as well as market size, to determine whether the Quoter or Eye can enter the market. Further, if a safety parameter is changed that improves on a quote value by a specified amount, the Quoter will shut down in an effort to prevent erroneous parameter changes.

Traders can also use the Quoter Limits to set the maximum number of contracts that can be quoted at any given time as well as the size of each individual quote. Hedger limits enable users to set the number of contracts to be sent within a certain time period as well as the maximum number of contracts sent on a single order.

In addition, traders leverage Fill and Underlier Protections to shut down the Quoter or Eye if fills accumulate greater than a set rate, or if a price gap occurs.

Conclusion

Blue Trading System is dedicated to providing compliant technology for today’s ever changing and regulated markets. We’d love to hear from you about how to make these or any of our features better. Your success is our priority, so let us know how we can help.