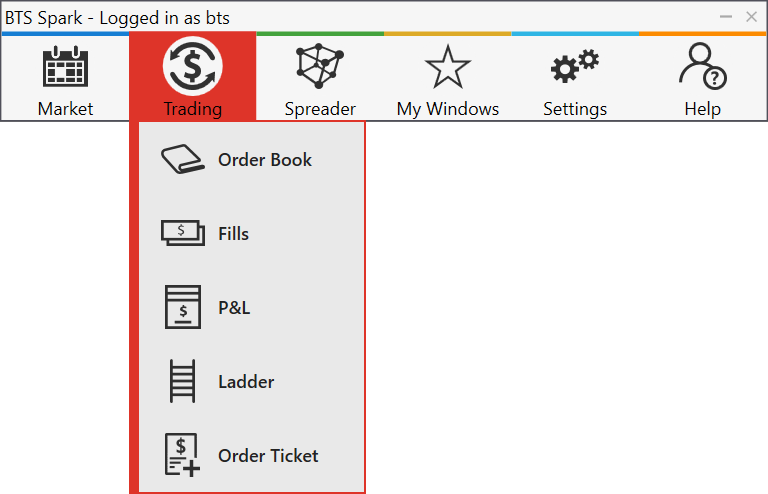

Trading

- When hovering over, it will show 5 windows which can be launched, Order Book, Fills, P&L, Ladder, and Order Ticket

- It appears like below:

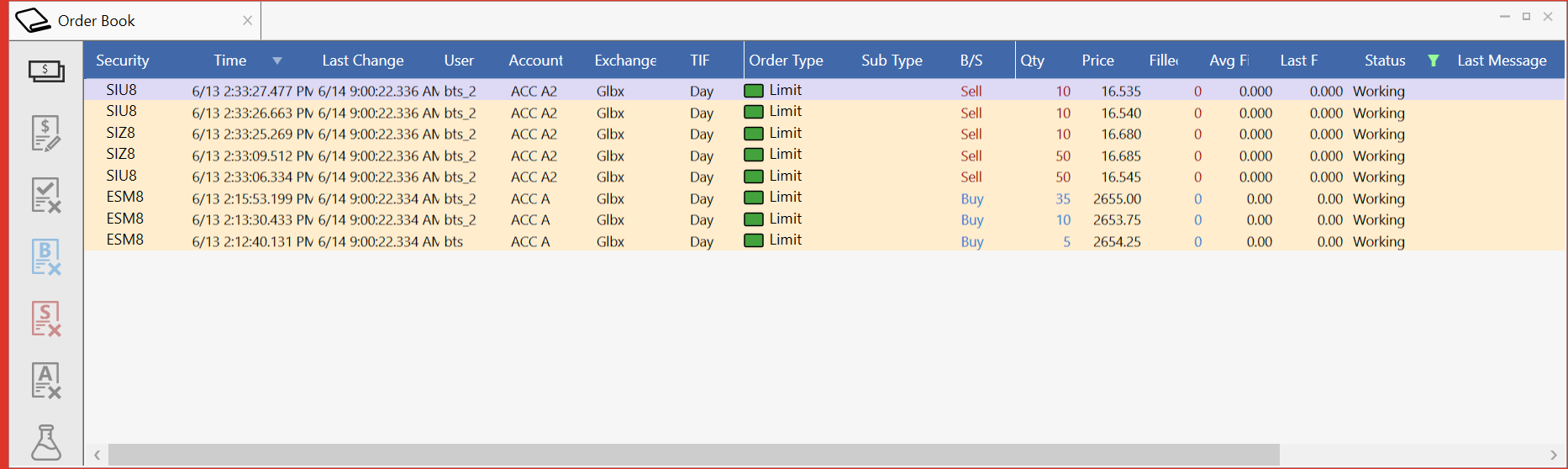

Order Book🔗

- This provides a list of all orders a user has placed, by default it will display only working orders

- You can create multiple order books filtered however you would like

- All order books are brought up as tabs and can be combined with all other windows within BTS

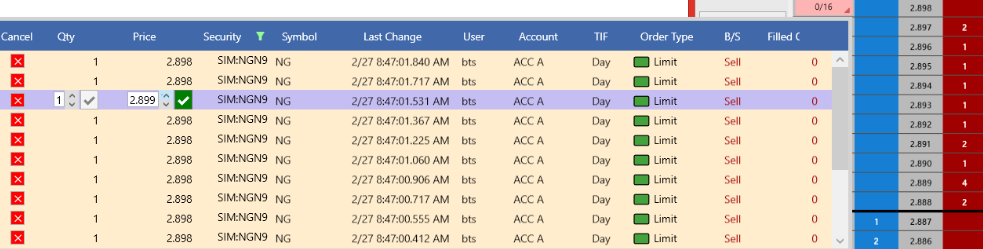

- Appears like the following:

- You can sort all columns by single left clicking on the column header which will sort in either descending or ascending order, an up or down arrow will appear representing which way it is sorting. Below is a display of the security column sorting in descending fashion.

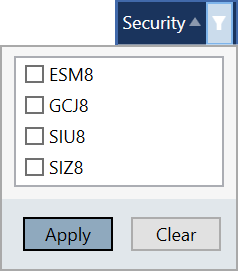

- Filtering can occur, by hovering over any column header which will display a “Filter” box. Clicking on this will then display the available components which can be filtered, below is an example of clicking on the securities column

-

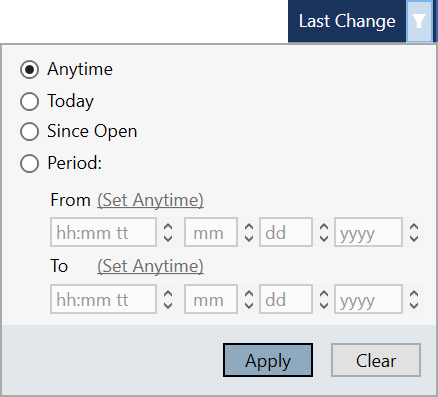

If the column is displaying time base information, a special style box will appear when clicking on the filtering box providing more options than simply filtering of the available information. You can choose the following time frames in which to filter:

- Anytime

- Today

- Since Open

- A specific user-defined period of time

-

The left-hand box within an order book provides users with further functionality to quickly perform various tasks with live orders as well as launch other modules. It appears like the below:

Fills -

clicking on this will launch a fills window

Fills -

clicking on this will launch a fills window Modify -

clicking on this will launch an order ticket for a live order

highlighted in the Order Book.

Modify -

clicking on this will launch an order ticket for a live order

highlighted in the Order Book. Cancel

selected - clicking on this will cancel the selected orders you have

highlighted in the order book. You can choose more than one by

holding hold the Ctrl key when clicking on each row of orders

Cancel

selected - clicking on this will cancel the selected orders you have

highlighted in the order book. You can choose more than one by

holding hold the Ctrl key when clicking on each row of orders Cancel

buys - clicking on this will cancel all the buy orders you have in

the order book

Cancel

buys - clicking on this will cancel all the buy orders you have in

the order book Cancel

sells - clicking on this will cancel all the sell orders you have in

the order book

Cancel

sells - clicking on this will cancel all the sell orders you have in

the order book Cancel

all - clicking on this will cancel all working orders you have the

order book

Cancel

all - clicking on this will cancel all working orders you have the

order book Recreate - clicking this will recreate already cancelled orders, sending them back to market with the same price and quantity as they were previously at before being cancelled.

Recreate - clicking this will recreate already cancelled orders, sending them back to market with the same price and quantity as they were previously at before being cancelled. Collapse all - This will collapse all trees inside the order book to show only the top level of the order.

Collapse all - This will collapse all trees inside the order book to show only the top level of the order. Expand all - This will expand to show everything inside the order book.

Expand all - This will expand to show everything inside the order book. Settings - This launches the settings for the orderbook.

Settings - This launches the settings for the orderbook.- Furthermore, there is a “floating” or “mini orderbook” feature as well

integrated within the ladder itself.

- To access this, you need to center click with your mouse wheel over

working orders on the ladder.

- From here, you can change the price and quantity of any working order

within the mini orderbook straight from the window

- This looks like below:

Fills🔗

- This provides a list of all fills a user has had for a given time period, by default it will open up with “since open” timeframe selected showing you fills on the day thus far

- You can create multiple fill windows, filtered however you like

- All fill windows are brought up as tabs and can be combined with all other windows within BTS

- There is also a settings button in the left hand tab which can be launched to customize the fills window

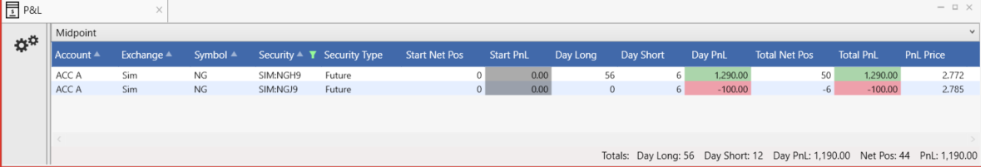

P&L🔗

-

This provides a running ledger of a users account(s) profit and loss, broken down per symbol

-

You can create multiple P&L windows, filtered however you would like

-

All P&L windows are brought up as tabs and can be combined with all other windows within BTS

-

All columns are sortable and either searchable or can be further filtered by entering in min and max values.

-

There is also a settings button in the left hand tab which can be launched to customize the P&L window

-

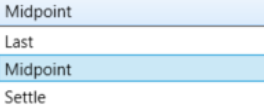

In regards to the PnL specifically, you can choose how you want the PnL calculated based on Last, MidPoint, or Settle price.

-

This is accomplished on the top bar, which when clicked on, displays the choices for calculation, this appears like below:

-

Below is an example P&L window showing a user’s multiple accounts and various positions in each:

Ladder🔗

- The ladder was designed to be the most logically produced ladder on the market, engineered and designed by professional traders for professional traders

- Ladders are launched as tabs and can be combined with all other windows within BTS

- Ladders are the quickest and easiest way to enter an order into the market with a single click

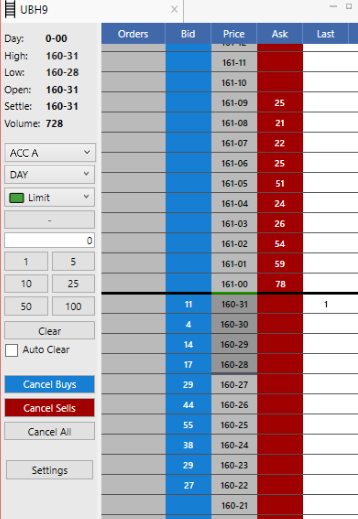

- Below is an example ladder:

-

The ladder consists of 2 major parts, the Ladder itself and the information and control section on the left-hand side

-

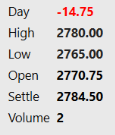

The information section on the left contains the following:

- Day - showing the current price of the security on the day

- High - showing the high price of the security on the day

- Low - showing the low price of the security on the day

- Open - showing the open price on the day

- Settle - showing what the security settled at in the previous trading day

- Volume - showing the last traded volume of the security in real time

-

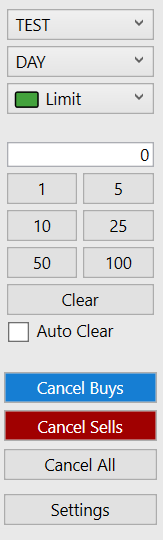

The control section right underneath the information section on the left-hand side offers the following:

-

The account in which the orders will flow into when trading this security

-

Length of time the order will remain in the market, either DAY or GTC

-

Order type, by default, orders will go in as Limit, however all of the following are offered out of the box. The top 5 are all fairly standard order types, however, the bottom 5 are all specialized algos. They are only offered by BTS and require specialized parameters. Please see below for each order type:

-

Market

- This is a buy or sell order to be executed immediately at the current market price.

-

Limit

- This is a buy or sell order designed to take place on the price level where you entered the order.

-

Stop

- This is a buy or sell order only when a security increases or decreases past a particular point, thus limiting or locking in profit or loss

-

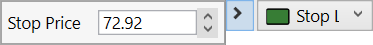

Stop Limit

- This is a buy or sell order which will be executed at a certain price after the given stop price is reached. You will need to enter the stop price, by clicking on the “<” to bring up the stop price option:

-

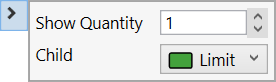

Iceberg

- This is a buy or sell order where the order is divided into a visible or “show” portion which is seen at the exchange. The rest of the order is hidden and will remain hidden until the show quantity is filled, essentially reloading the order back to the show quantity. You will need to define what type of order that will be used for the child order to be sent.

-

Time Box

-

This is a type of order set up to allow a user to enter an order at a certain time and stop an order at a particular time as well. The options to either start or stop an order are the following and can be combined in any fashion, i.e. you can start immediately and stop at a certain time, or start at a certain time and not stop until the order is completed.

- At

- In

- Immediately

-

Once the time frame is chosen, you will need to then choose the order type of the order that will be entered into the market.

-

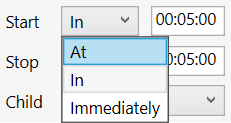

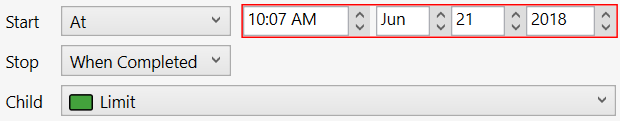

Below are images of the type of time frame that can be used within the time box

-

-

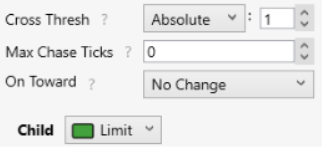

Lean

-

This is a specialized algo order which allows the user to essentially watch the opposite-inside market size and cross when that size goes below the threshold defined.

-

“Cross” means to take an order working on the bid and 'cross' by buying into the asks. This is often referred to as “paying up” as well

-

-

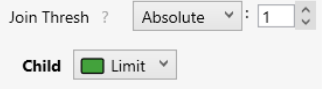

Join

-

This is a specialized algo order which allows the user to enter an order which will watch the opposite-inside market and join when the market flips and has at least threshold size as defined.

-

-

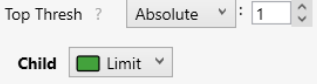

Top

- This is a specialized algo order which allows the user to essentially not trade by themselves

- If the order is on the market (current bid price) and the quantity

on that bid price is below the top threshold defined the order will

cancel and do nothing else

-

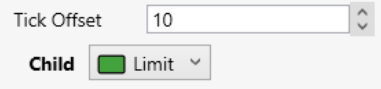

Offset

- The goal of the offset order is to send your order X amount of ticks

from where you actually place it on the ladder. This is sometimes

known as a "fat finger" safety.

- The goal of the offset order is to send your order X amount of ticks

from where you actually place it on the ladder. This is sometimes

known as a "fat finger" safety.

-

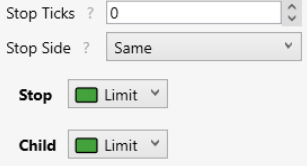

OCO

-

An OCO order creates a relationship between a child order and a 'stop' or 'other' order such that when one of these is cancelled, both cancel, or when one is filled, the other order's size is debited in the amount of the fill. Composing this order with Cover simulates scalping functionality.

-

-

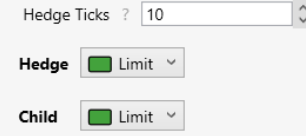

Cover

-

A Cover order’s purpose is to fire a hedge order (of any algo-type) in response to fills from it’s child order on the opposite side of the market N ticks away.

-

-

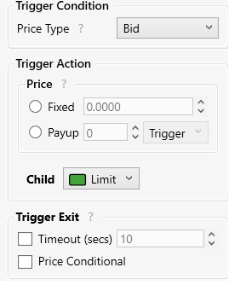

Trigger

- The Trigger order is exactly as it sounds, where it will trigger an order based on conditions defined.

- This order also has exit strategy built in where a user can define when the trigger order can auto-cancel based on time as well as price conditional.

-

-

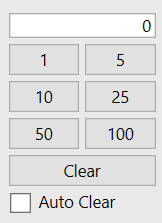

The middle of the control section is where you can click on predefined values to quickly populate the volume at which you wish to enter the market.

- You can manually type in a quantity here as well

- Furthermore, if you have a value in the volume bar, you can increase this size by right-clicking and the value will increase incrementally by 1. The same is true if you would like to decrease this value by left click and the value will decrease.

- By having the auto clear box checked, it will bring the value back to zero after placing an order at the size chosen.

-

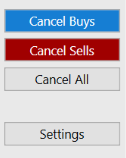

The bottom section of the control area of a ladder has 4 aspects to it

- Cancel Buys, which will cancel all buys currently working on the ladder

- Cancel Sells, which will cancel all sells currently working on the ladder

- Cancel All, which will cancel all orders on the ladder

- Settings, which will launch the ladder settings window which

appears like below

- Fonts and Colors - This is where you can customize the overall main aspects of the ladder.

- Market Break Lines - These are where can control the viewing of what has been traded through various shading.

- Market Size Display - This is where you can define if you wish to see implieds or not and how exactly you would like to see them.

- Volume Display - Where you can choose to show the volume traded at price graph and what details you would like to see.

- Size Presets - Here you can define what volume of predefined quick buttons you would like to see or any at all. You can remove these by clicking on the “X” next to the volume number to remove one or many.

- Algo Favorites - Here you can set up which “quick button” or user defined algos to see. You can customize the amount of columns to be displayed as well.

- Left Panel - This is where you can remove predefined information on the left panel to save room and get rid of data that you might not require to see.

-

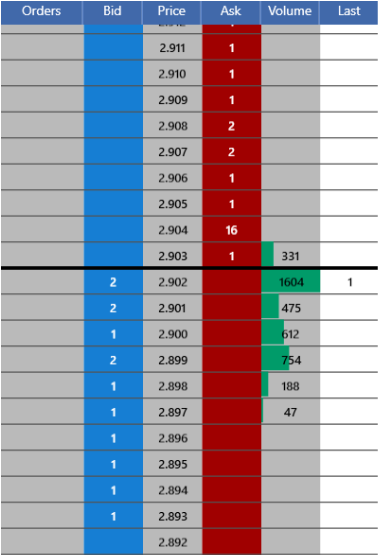

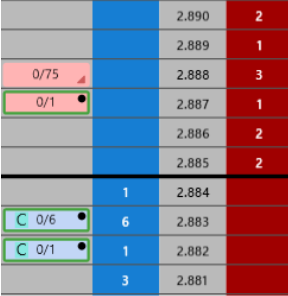

The other, main part of the ladder, is the ladder itself as displayed below

-

There are 5 main columns

- Orders, which display current orders working in the market

- Bid, which displays the current bid volumes at each price level

- Price, which displays the price levels of the symbol shown

- Ask, which displays the current ask volumes at each price level

- Last Trade, which displays the price level and volume where the last trade occurred

-

Functionality of the ladder

- To enter an order directly by clicking in the ladder, left click on either the bid or ask volume with a volume greater than 0 on the predefined value box on the left-hand section

- A badge will be displayed within the orders column of the value you have chosen and the quantity filled as displayed below

-

To change the price level you wish to work the order, you can right-click and hold on the badge to move it up or down the ladder for the desired price

-

To cancel the order, left click on the badge

-

Furthermore, you can click down on the scroll wheel of your mouse to bring up a cancel or detach option

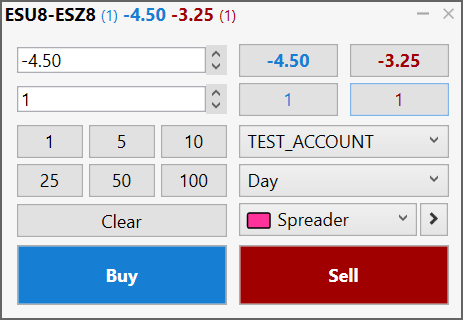

Order Ticket🔗

- The order ticket was designed to provide another means other than the ladder to enter orders into the market

- You can bring up an order ticket directly from the module launcher, which will bring up the security browser where you can then choose which security to populate

- The order ticket appears like below

-

On the top left, you have the price for the order as well as the volume

-

Beneath are the predefined volumes as well as a clear button to clear out the volume

-

On the top right you have the current bid and ask and volumes of each for the security chosen

-

You can populate the price and volume by clicking on either the bid or ask price as well as the corresponding volumes

-

Below you have the account drop down, the duration of the order, and the order type

-

Please note you can also launch the required parameters for algo or synthetic orders by clicking on the right arrow next to the algo or synthetic

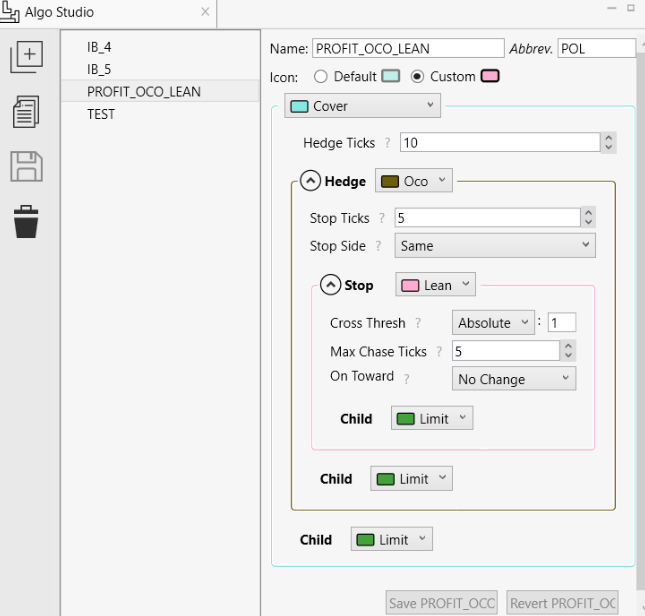

Algo Studio🔗

-

The BTS Algo Studio was built for users to experience algo composability never seen before in a professional futures trading system.

-

There is no limit for putting both “canned algos” already present in the system as well as user defined algos fed into the system via the API.

-

This is all in place in a very user friendly GUI as shown below:

- There are 3 main areas of the Algo Studio:

- Left Pane (from top to bottom)

- Add Algo

- Clone Algo

- Save Algo

- Remove Algo

- Middle Pane

- This is where your customized algo will be displayed in a running list

- Right Pane

- This is where your complete customization happens of combining various algos together and saving them to fit your exact needs

- On the very top are the name and abbreviation boxes

- For the name you can simply name the algo whatever you would like

- For the abbreviation section (which is optional), you can put in an abbreviated name for the algo which will be displayed on the Algo buttons on the ladder. (Example - Algo name = PROFIT_OCO_LEAN, Abbrev. = POL)

- Left Pane (from top to bottom)