“If you are not looking at Market By Order (MBO) data, you are missing valuable information that could significantly impact your trading operations,” said Kevin Darby, Managing Partner at Blue Trading Systems. “MBO data is going beyond simple price book to provide our users with a holistic view of the market.”

Blue Trading Systems (BTS) recently announced expanded market connectivity services to include ICE Futures Markets as well as an enhanced version of BTS Spark, an algorithmic futures trading system designed from the ground up to provide unprecedented power, speed and reliability. The new optimized version includes a variety of key feature updates such as faster response times for better queue position, an advanced approach to design new strategies on the fly, and unique ways to visualize MBO data. We sat down with Kevin Darby to dive into the MBO functionality and why the market analysis capabilities were added to this newest release.

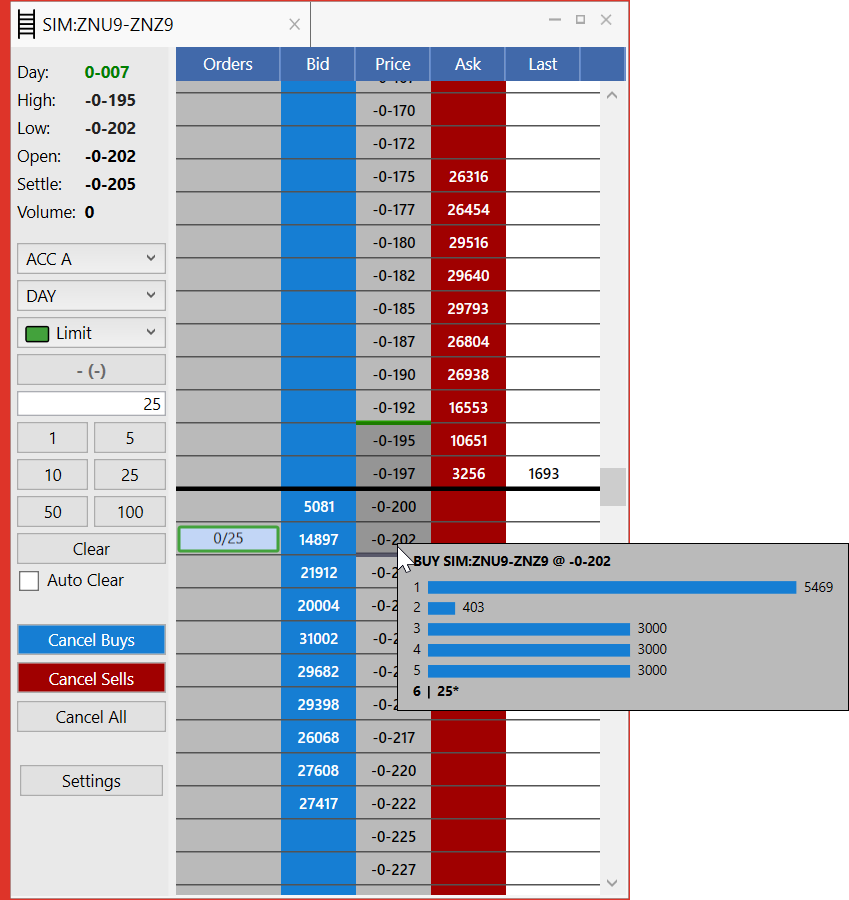

“Market by Order functionality is a way to view orders at each price level in an anonymous fashion,” said Darby. “BTS customers can see individual orders in queue, sectioned by price.”

The order-based data feed provides users with full depth of book and the size of individual orders at each price level. The BTS API enables users to pull MBO information and customize it for specific market analysis.

BTS has seen a variety of users leverage the MBO functionality including users trading the treasury roll as well as algo developers.

“Treasury roll traders gain insight into the structure of size at each price level,” said Darby. “Algo developers can use this data to more accurately model price dynamics, rather than relying on a simple price book heuristic.”

He said that hedgers can also gain a competitive edge by utilizing MBO data to find concentrated size.

“There is a big difference in trying to sell 200 to a 150 lot and 50 lot, compared to 200 1 lots,” he said.

BTS added the MBO functionality to the most recent release of BTS Spark, after it was suggested by customers.

“We knew CME offered the feed but waited to display it until after we worked with clients to develop the best way to visualize this data,” he said. “Client feedback was a big part of the development cycle for this feature.”

Currently, BTS is researching how MBO functionality helps their client base and how data can help their customers develop better algorithmic building blocks in the BTS Algo Studio.

BTS started this research using the historical MBO data provided by CME Datamine.

“We believe that the standard algos such as Join and Lean or the Spreader can benefit from this richer data stream,” said Darby. “Taking into consideration this microstructure could provide a leg up in hedging and general trading operations.”

If you are interested in learning more about BTS Spark and the enhanced functionality, we invite you to visit Booth 1013 at the 35th Annual Futures Industry Association’s (FIA) Expo or email This email address is being protected from spambots. You need JavaScript enabled to view it..