The BTS Edge P&L Report has been enhanced to display both risk and profit-and-loss information in the same view. The new report also allows easy viewing of pre-committed scenario analysis. This improved resource allows traders to view the full set of Greeks, to provide a better breakdown of per expiration Greeks, and to easily analyze profit and loss. Read below to see how traders are successfully leveraging this feature.

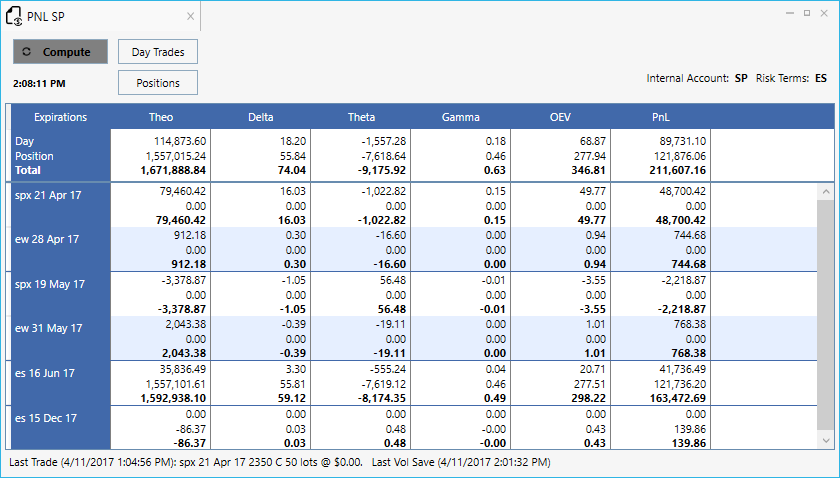

Enhanced P&L Reports

We improved the P&L Report performance to quickly reflect position and volatility changes. We also added the ability to view the full set of Greeks, including tertiary Greeks such as Charm, Vanna, Volga, etc. Users can view the breakdown of positions by expiration as well as observe the trader’s position versus day trades. We also made it easier to view day and position P&L Reports, which can now be opened directly from the P&L Report.

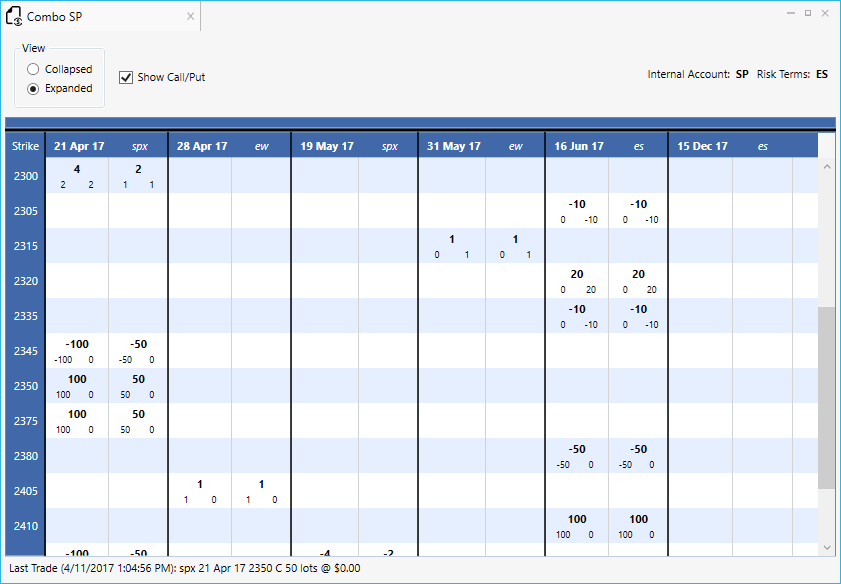

New Combo Report

We also redesigned the Combo Report to seamlessly fit into the BTS Edge front end. The report can now be tabbed with other windows and expanded or collapsed in a manner similar to the Slide report. Users can also see individual Call or Put positions as well as the last trade incorporated into the Report.

Risk Slide Report Scenario Analysis

Finally, our Risk Slide report now offers complete pre-committed scenario analysis. Users are able to locally observe the effects of any pending input change to the Risk Slide, including ATM volatility moves, risk reversals, and time or settings changes; this is useful before sending out a change to the rest of your team. The Slide Report now makes it clear to the user when they are viewing a simulated scenario analysis versus live risk.

If you are interested in learning more about the enhanced BTS Edge P&L and Risk Report functionality or about how Blue Trading Systems can work for you, please feel free to contact us with questions or to schedule a demo.