News

- Details

Blue Trading Systems’ Kevin Darby is attending the 2017 Options Industry Conference. If you are interested in learning about our impressive latency numbers, or how BTS can improve your options trading strategies and accelerate your quoting times contact us to schedule a meeting.

With low latency and agile software solutions, we provide options market makers and proprietary trading firms forward-thinking resources that meet today's demanding markets. Our feature updates are seamless, our customer service is responsive, and our success is dependent on your success.

Click here to schedule a meeting!

- Details

BTS's Ultra Low Latency Quoter

Blue Trading Systems is proud of the work we are doing to provide the lowest latency platform available. This week we take a look at the performance of our newest CME Quoting Engine.

Our Numbers

In order to obtain meaningful predictors of real-world performance we setup an instance of our Quoter as we expect it to be used in production: we used commodity hardware and production market data and configured the Quoter to maintain quotes on high delta options on the CME ES Future.

Using a high-performance logging facility our Quoter recorded arrival times for the ES future and departure times for the corresponding mass quote update messages. These two data points were captured during a 20 minute window.

From the resulting data we were able to extract a distribution of about 100 tick to quote times. To understand how the number of configured quotes affects the Quoter performance we repeated the experiment for different quote quantities, starting at 20 quotes and ending at 1280.

Read more: Feature Highlight – Latency

- Details

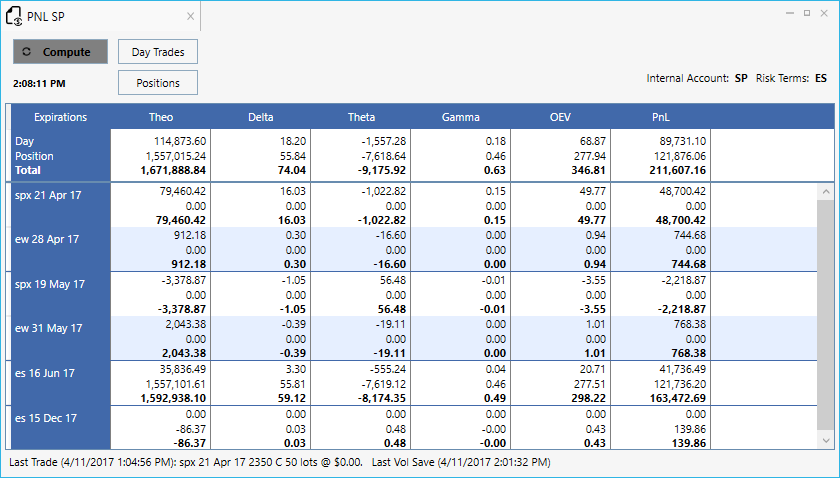

The BTS Edge P&L Report has been enhanced to display both risk and profit-and-loss information in the same view. The new report also allows easy viewing of pre-committed scenario analysis. This improved resource allows traders to view the full set of Greeks, to provide a better breakdown of per expiration Greeks, and to easily analyze profit and loss. Read below to see how traders are successfully leveraging this feature.

Enhanced P&L Reports

We improved the P&L Report performance to quickly reflect position and volatility changes. We also added the ability to view the full set of Greeks, including tertiary Greeks such as Charm, Vanna, Volga, etc. Users can view the breakdown of positions by expiration as well as observe the trader’s position versus day trades. We also made it easier to view day and position P&L Reports, which can now be opened directly from the P&L Report.

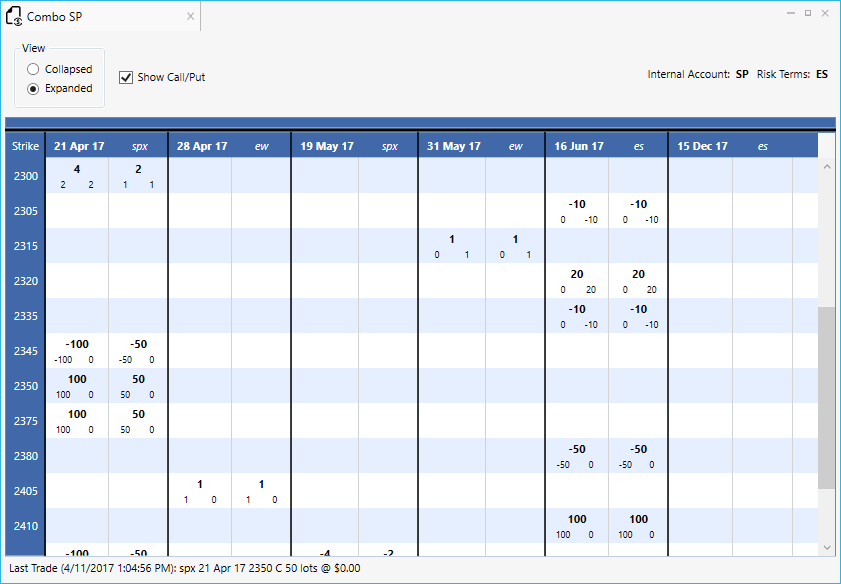

New Combo Report

We also redesigned the Combo Report to seamlessly fit into the BTS Edge front end. The report can now be tabbed with other windows and expanded or collapsed in a manner similar to the Slide report. Users can also see individual Call or Put positions as well as the last trade incorporated into the Report.

Risk Slide Report Scenario Analysis

Finally, our Risk Slide report now offers complete pre-committed scenario analysis. Users are able to locally observe the effects of any pending input change to the Risk Slide, including ATM volatility moves, risk reversals, and time or settings changes; this is useful before sending out a change to the rest of your team. The Slide Report now makes it clear to the user when they are viewing a simulated scenario analysis versus live risk.

If you are interested in learning more about the enhanced BTS Edge P&L and Risk Report functionality or about how Blue Trading Systems can work for you, please feel free to contact us with questions or to schedule a demo.

- Details

Blue Trading Systems’ Taha Afzal and Kevin Darby attended the FIA Boca conference last month in Boca Raton, Florida. Many of the sessions focused on how regulation impacts our industry and therefore, our technology. Blue Trading Systems is committed to helping our customers stay compliant through technology. We include 15c3 risk checks within the software and are also developing a leverage report to help firms stay under Basel capital limits.

Regarding regulatory risk management, Blue Trading Systems' clients leverage safety and security features within the BTS software. With the regulatory topic fresh in our minds from FIA Boca, we wanted to outline some features within our platform that help our clients daily. With trader and account permissions, a built in SPAN margining system, and other risk limit functionalities, traders are able to maintain margin requirements as well as prevent erroneous trades, which allows risk managers to do their jobs more efficiently.

Have a Question?

Chicago

318 W Adams St

Suite 1724

Chicago, IL 60606

Telephone: (919) 913-0850

Chapel Hill

194 Finley Golf Course Road

Suite 100

Chapel Hill, NC 27517

Follow Us

Email: info@bluetradesys.com

Twitter: @bts_software

LinkedIn: Blue Trading Systems

Facebook: Blue Trading Systems