News

- Details

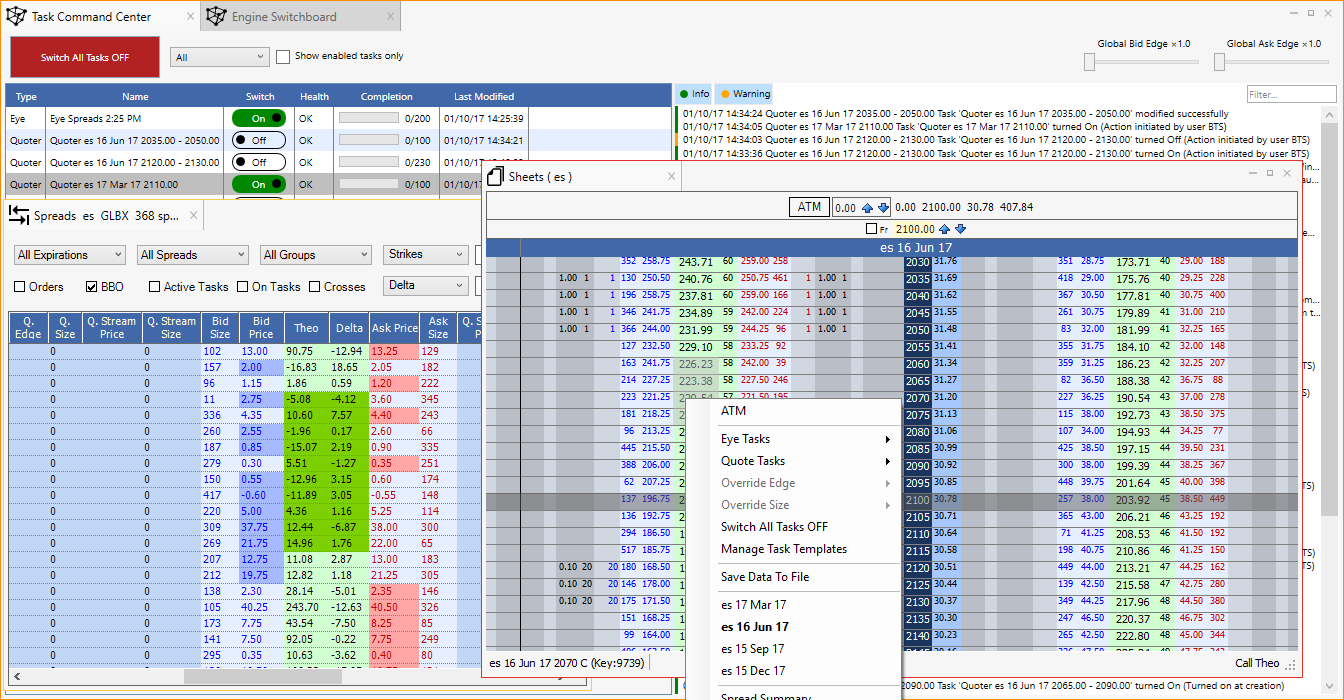

Our roots in the options trading industry have allowed us to create an intuitive interface to our ultra low latency quoter. Electronic quoting is done with our Tasking interface, and is integrated into our trading sheets and spread book.

Simply right clicking on either the sheets or spread book lets you create a new quoting task or edit an existing one. You can easily set the edge and size for bid and ask, specify the target number of contracts, and start quoting with only a few clicks, or you can further streamline the process by making templates beforehand.

You can quote a range of outrights by quickly dragging over the rows in the options sheets, or quote a range of spreads with the same actions in the spread book. Securities can be added or removed before the task is started. Any task can be paused and edited from sheets or spread book where it was created or in the Task Command center where all tasks are listed by name.

- Details

We would like to thank you and wish you a happy and prosperous 2017.

Over the past year, Blue Trading Systems has brought many new features to you. We delivered our innovative new tasking system, completely revamped volatility management tools, new and dramatically improved analytics, a more modern and efficient interface, and many more features and improvements. We have also improved our quality assurance testing to bring you safer, more reliable releases.

Coming in 2017, in addition to significant speed improvements, we are excited to bring our trusted risk management to more users as a stand-alone application. We also plan on launching first class API access to our system. New and existing customers will be able build custom tools on top of a BTS foundation.

We will have more to announce as the year progresses, so if you haven’t yet joined, please sign up for our mailing list here.

- Details

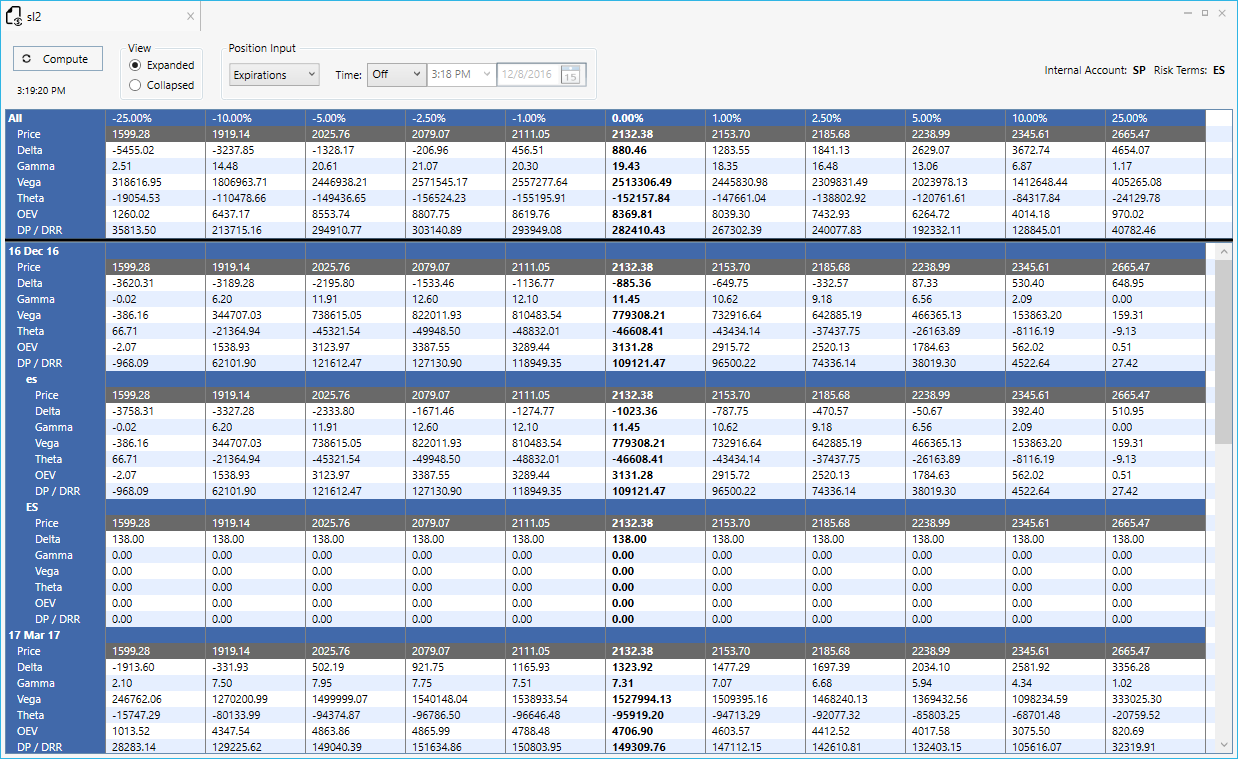

"What's my risk?" "What happens to my account when interest rates move?" "How can I hedge my position?"

BTS Risk is a standalone application that uses the same proven, proprietary technology as our market making application. Import your position from your clearing file or a standard CSV and look at scenario analysis across underlying, vol and interest rate scenarios.

With BTS risk you can both see your exposure and compute how many futures you should trade to hedge.

BTS Risk also offers trade by trade synchronization with CME drop copy.

If you are interested in learning more, or would like to be notified once BTS Risk becomes available please fill out the form at bluetradingsystems.com/risk.

Have a Question?

Chicago

318 W Adams St

Suite 1724

Chicago, IL 60606

Telephone: (919) 913-0850

Chapel Hill

194 Finley Golf Course Road

Suite 100

Chapel Hill, NC 27517

Follow Us

Email: info@bluetradesys.com

Twitter: @bts_software

LinkedIn: Blue Trading Systems

Facebook: Blue Trading Systems